Or log in with

TAX PREPARER

Volunteers who serve as Tax Preparers offer free tax return preparation services to eligible taxpayers. Tax Preparers must accomplish the following requirements: Successfully pass three (3) exams: the Standards of Conducts, the Intake/Quality Review, and the Advance Exams, and attend a Tax Preparer Orientation.

STEP ONE: CREATE A UNITED WAY SUNCOAST VOLUNTEER ACCOUNT

All Tax Preparers must have a United Way Suncoast (UWS) account to participate in VITA.

Returning Volunteers:

- Log in to your UWS account by clicking the yellow "log in" button at the top right corner of this page.

New Volunteers:

- Create your volunteer account >>here<<.

You must be logged into your UWS Volunteer Account to complete Step Two. After creating or logging into your account, return to this page to continue.

STEP TWO: REGISTER TO VOLUNTEER FOR VITA 2026 TAX SEASON

Every volunteer—new or returning—must fill out the registration form each year to stay active in the VITA program. If you do not complete the form, you won't receive important updates or information about volunteering with VITA.

- Make sure you are logged in to your United Way Suncoast account

- Fill out the 2026 registration form below

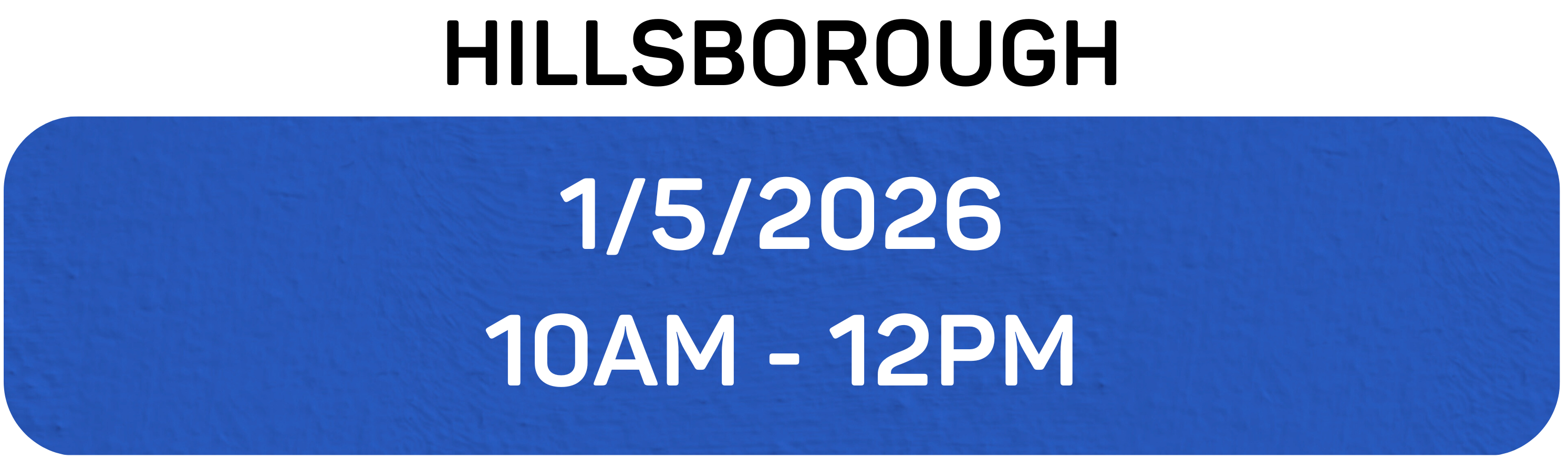

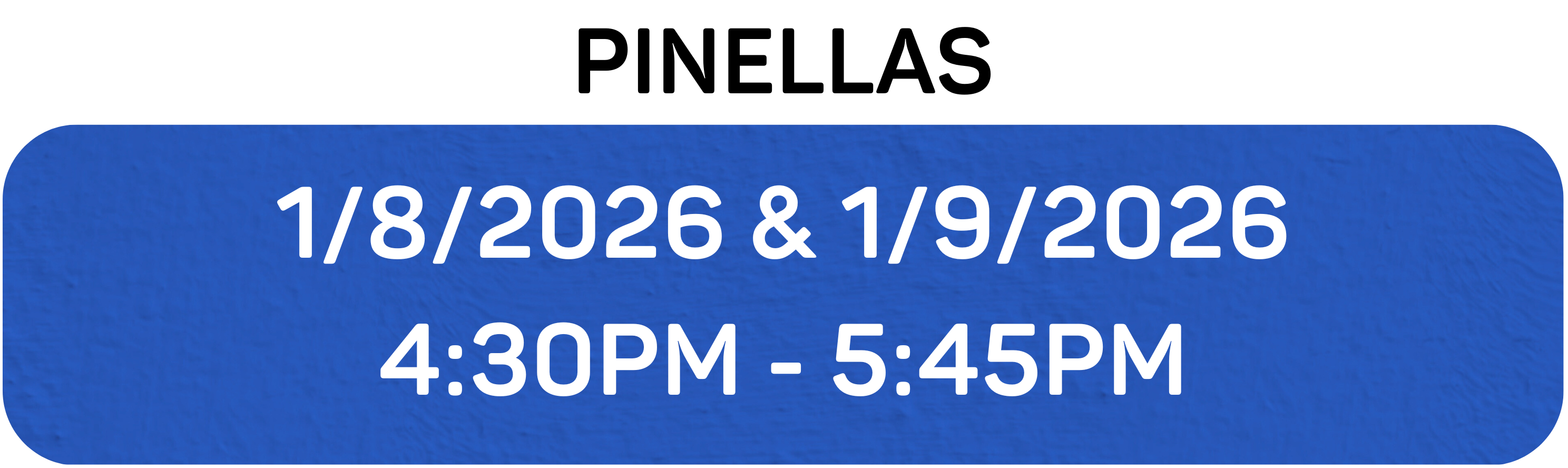

STEP THREE: GET CERTIFIED

There are 3 ways to certify, in-person, virtual, and self-certification. New Tax Preparers are strongly encouraged to participate in-person or virtual, as these sessions are specifically designed to guide volunteers through software navigation. Experienced Tax Preparers who have previously volunteered with VITA can opt for self-certification.

STEP FOUR: REGISTER FOR THE TAX PREPARER ORIENTATION

The orientation session aims to enhance comprehension of the expectations outlined by the Internal Revenue Service (IRS) and United Way Suncoast (UWS) while we engage in serving our neighbors and communities. This orientation is a crucial component of preparing volunteers for their roles in the program.

During this session, program managers will provide information about:

- Updates to tax law

- Safety guidelines

- How to sign up for volunteer opportunities

- Where to find support when you have questions

- The most common questions that taxpayers have when they visit a site

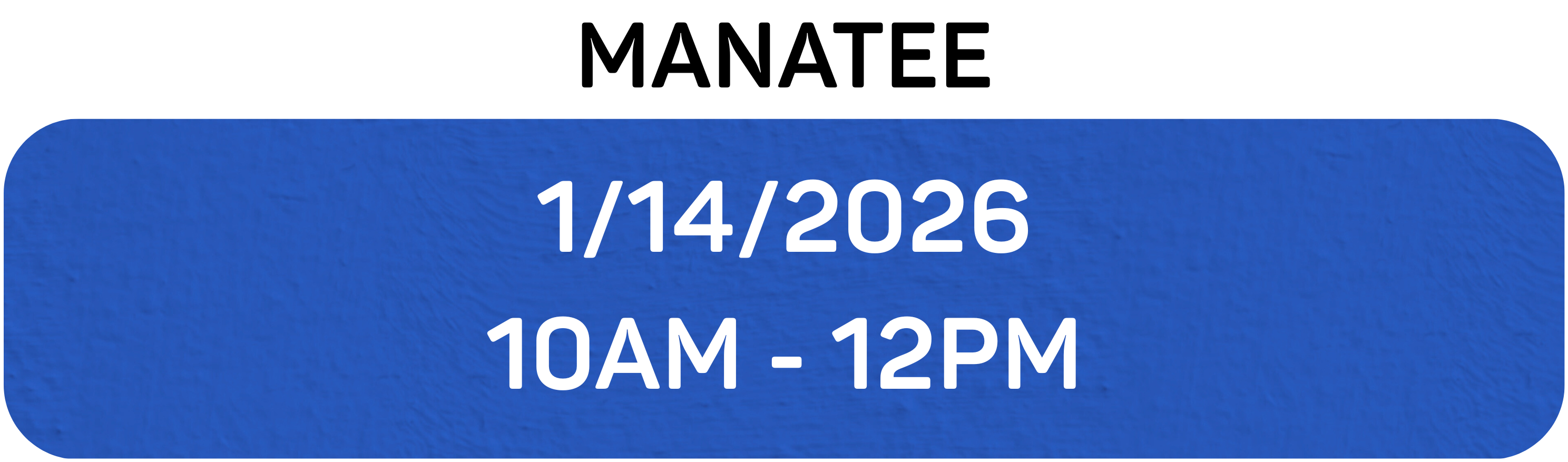

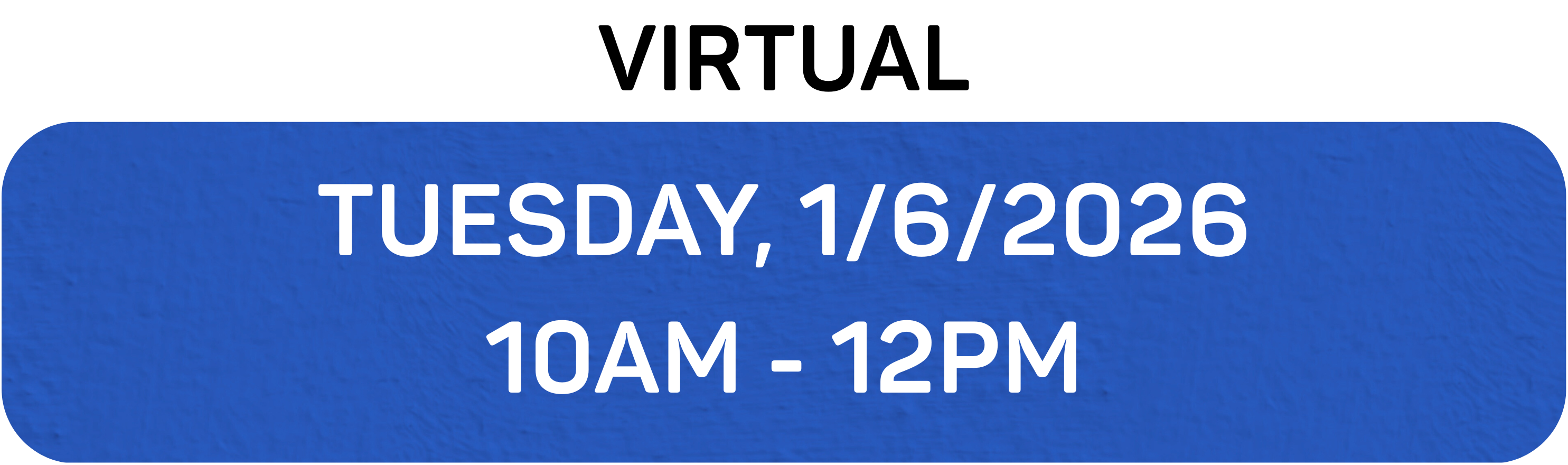

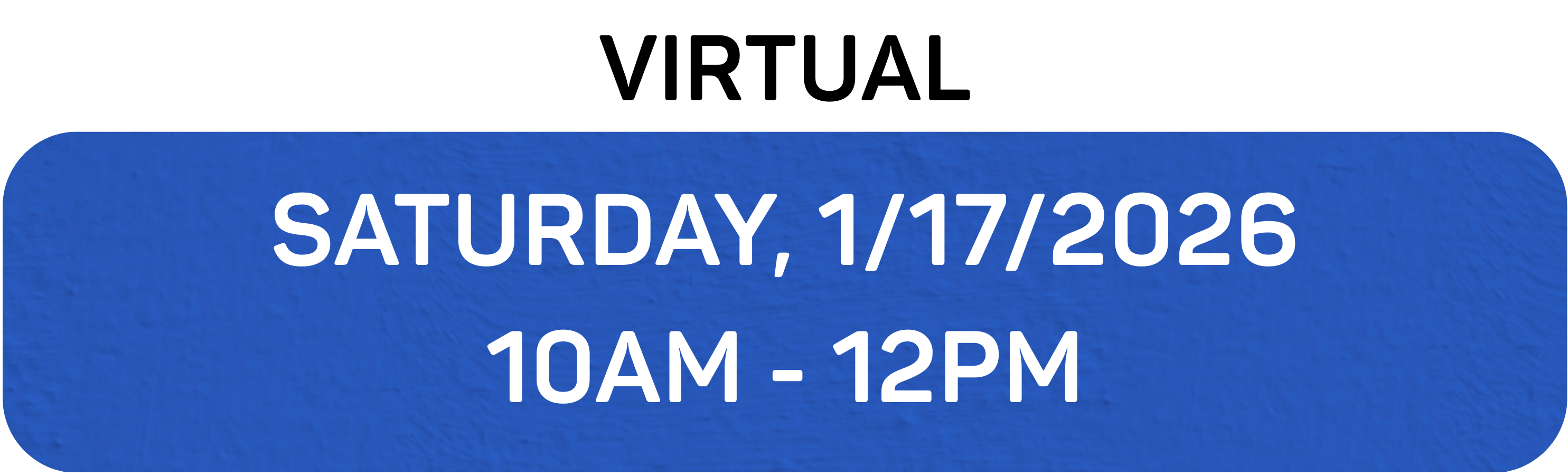

All VITA volunteers must attend an in-person orientation or virtual orientation. Register for only one date.

Optional Q&A: Connect, Engage, Ask, Discover

Whether you're new to VITA or in need of additional support, gather your questions and join one of our Connect, Engage, Ask, Discover sessions. These virtual sessions, led by an IRS professional, provide an open forum for volunteers to ask any questions or express concerns related to VITA.

.jpg)

.png)